Messing Up, One Day at a Time

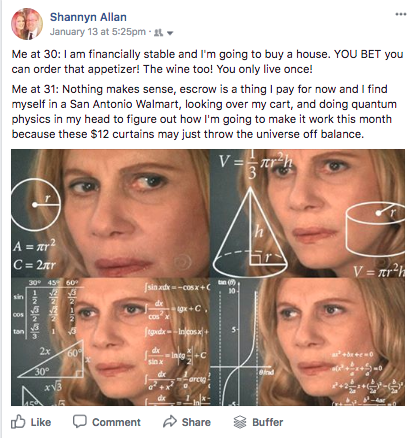

To best sum up how my life is going right now, I share with you a post from my personal Facebook page…..

Sometimes, when you think you have your sh*t figured out, you really don’t. You find yourself in the home decor section of Wal-Mart, evaluating your life choices and wondering how you got there.

Adulting is like throwing a crazy dinner party. You do your best to plan, but then everyone shows up at once and you have too many things cookin’.

Sometimes, babes, you drop and ruin things even with the best of intentions. Despite your best research on how to balance it all, you simply can’t watch all the burners. It’s best to always have a backup salad that doesn’t require heating, and plenty of alcohol to make the burned bits bearable. (Can you tell I’m a foodie?)

That is exactly how I would describe how most adults are trying to juggle life – too many things on the burners and too much wine.

House Fail

This all came to light for me in comparing my 30th year of living with my 31st. When I was 30, I was gearing up to buy the home we now reside in. I was cruising along to my 20% down payment and I had my little Roth IRA that I contributed the max every year. I was CRUSHING IT.

Except at 31, the house buying experience has made me wonder how I’ve even made it this far. It’s not fun to admit this, but owning this damn house has been one disaster after another.

This “dream house” of mine was supposed to be completely move-in ready with a new roof, new floors, new water heater, new HVAC. All of the big ticket items were done. Unfortunately, this adorable little bungalow has proven to be a money pit. While I’m very lucky, I’ve had a monthly series of expensive house problems that started the week we moved in that meant I was pretty emotionally and financially spread thin.

With all of the house issues, I wasn’t paying close enough attention to my new expenses. One giant thing I missed was that my mortgage was set up based on outdated property valuations from the year before I bought the house, NOT its current value, Here I thought I had finally started getting a handle on all this house crap and instead I got a big ol’ bill I wasn’t prepared for. That bill was for a whopping $3,226.

Thusly, in short, my escrow account wasn’t funded sufficiently and I would need to make up the difference in short order. Talk about a kick in the ovaries. Ouchies.

Do Not Pass Go. Do Not Collect $200. You suck.

Escrow Account? WTF is that?

For those of you lucky enough not to already be playing the “Let’s Get A Mortgage!” game, your escrow account is essentially a part of your home buying package and thus, a part of your ongoing mortgage. It’s essentially where your money is held to pay property taxes.

A person walks around your neighborhood and checks out your home – sometimes from the curb, other times by asking to see inside your home. Literally, that’s how it works. (Ya, I know right? I will be dumping some trash in my yard if you need me.)

Yes, I know, there are other factors that come into play, like neighborhood values of other homes that are comparable to yours. But all I could think about was how that dream-killing tax person looked at my tip-top container garden and said: “damn, her porch is en pointe. We’ve definitely got to raise her taxes.”

I mean, I’d tax that cuteness too. Patio lemons?

You are required to keep your escrow nice and full to cover your butt for taxes. Remember, the government always, always gets their share. In my case, I missed the key thing: understanding what factors impacted how my escrow account was calculated.

Unfortunately, my home was valued at a lot in more in 2017 vs. 2016 due to the improvements that were made to sell it. But that was the valuation they pulled into my mortgage, despite the fact that 2017 numbers were available by the time I closed on a home.

Yes, I should have caught this. But in the rush of paperwork, and in the flurry of saving my $52,000 down payment from fraudsters (that story to come!), I sort of glazed over that fact and figured I would be able to handle any tax increases as they came.

Emergency Fund = SO Important

Life does not go as planned. Sure, it’s unlikely you’ll be dealing with a family of skunks, electrical fire damage, improper wiring, and a leaky roof all at once like I did. But that’s why having savings set aside for the knowns and the unknowns is key.

Unfortunately, I will be hit with another tax hike for 2018. Again, if I had crossed my T’s and dotted my I’s to make sure I had the money in savings for these abrupt changes, I wouldn’t be writing this post. Sometimes, though, you have to learn by doing. You can read about the theory of gravity in a book, or you can also expedite that discovery process by falling down a flight of stairs. Hopefully, though, you can learn from me and avoid your own painful flight of stairs.

And HE’S OKAY!!!!!

Hemorrhaging Money

This was one of those posts I wasn’t super excited to be sharing – but the path forward isn’t always a straight line. Sometimes you make strides, take your eyes off the prize for a bit, and realize you’ve broken some stuff. At that point, you can chalk it up to learning and make adjustments with the new data you’ve acquired, stair style.

For the sake of full head-slapping transparency, I was a frugality writer at Frugal Beautiful for 7 years. Yet, in 2016 & 2017, here I was bleeding out money from every pore. Beyond putting 20% down on my home, I didn’t really have a budget or a reason to budget, so I was adrift.

Some expenses were new, like normal house repairs and some not so abnormal home repairs (like finding out half my house had no insulation- and no, the inspector didn’t mention it). But I was also contributing to a new 401k (which is a good thing!) through work, and ramping up our charity project, Virtual Charity Runs.

Not to mention, I had made a commitment to be a monthly donor to Planned Parenthood in Texas, the NAACP Legal Defense Fund, Texas Public Radio and a few other worthy causes. I felt I had plenty of cushion in my life and it was time to give back.

Yes, I had a lot of “good” expenses, but I also went on autopilot for some pretty ridiculous things. I had a lot going on, which meant I wasn’t paying attention, nor was I aligned with a bigger vision. These included, but were not limited to:

- Several subscription boxes, to the tune of over $1000 a year

- Hadn’t recently assessed my insurance coverage

- Overpaying for phone service

- Getting sloppy with meal planning

- Embarrassing amount of food waste

- Spending $300 more per year on getting my hair done

There were also a lot of other little things that slowly meant my intentionality was slipping. I fell into a routine of consumption without much thought. I bought more books and paid for more apps. These little things become big things over time, and yet you tell yourself you “simply can’t save any more,” but you’re just not trying. Yup, it can happen to anyone.

Essentially, I was really spread thin, really distracted, and I wasn’t paying close enough attention to my personal spending. Nor was I 100% committed to building an emergency fund back up. It caught up with me.

My assets wouldn’t cover my liabilities and I had made a fatal mistake- I figured I could handle it when the time came and of course, bills don’t care about your personal calendar.

I had now at least $5,000 in bills, knew another tax hike would likely be coming, and had an upcoming bucket list to pay for. And yet I only had about $2,500 in my emergency fund.

Getting Back on Track

I’m going to be honest – I’m learning from this mistake and doing two things I’m really uncomfortable with. My fella has given me an advance on his portion of the mortgage payments *and* I’m using a 0% APR Credit Card to get me through the next 3 months and pay for the attic repairs and insulation we need.

Yes, yes, yes, I hear you. I am not a fan of this either. Hell, I have never been in credit card debt, ever. But, I have a 12 month introductory period with no interest, and I will be cutting expenses after our Europe trip. This will ensure that my $3,000 in credit card purchases are paid off in five months and any cash that my fella fronts to cover the property tax will be paid back in the next four months.

Is it ideal? Heck no. Am I going to hustle? Heck yes.

I also have another goal: to get my emergency fund back up to sustainable levels. My aim is to have at least $5,000 in liquid savings, at least $1,000 in the property tax slush fund savings account, and get my travel savings to at least $1,000.

I’m also going to be setting aside monthly savings to cover any property tax hikes in the future and ensure I’m prepared. I also know how to contest my property taxes and file for a deduction now, so I’m armed with a new knowledge I didn’t have before.

For some extra cash, I’ll also be doing the following:

- Selling 6 of my old Kate Spade purses, which will hopefully make me around$500 in income. I have about 3 bags I use regularly; I definitely don’t need 9.

- We’ve fully booked our spare room out with Airbnb (assuming all things go to plan), which will generate $4,800 in income.

- I’ve picked up some side hustle writing gigs that will generate over $7,000 in the next 6 months.

Because of these knew, concrete goals, I can still make it work to get my house in working order AND continue to donate to causes that I care about. I’m getting trained as a volunteer with Planned Parenthood and a local foster care organization, so I can give my time as well. It feels GREAT to have purpose beyond just financial goals. And I am proud that I have gotten my shit together after a really difficult year.

Because, remember, sometimes you have to learn by first falling down a flight of stairs, but it’s your choice how long you want to stay at the bottom.